The Case of the Contaminated Perrier – 1990

Panic engulfed the French Perrier company when a North Carolina chemist found traces of benzene

Panic engulfed the French Perrier company when a North Carolina chemist found traces of benzene

Most people know the story of Carrie, the awkward teenager with a fanatically religious momma.

Movie director Mike Nichols described Ishtar as ‘the prime example that I know of in

After decades of losing market share to the ‘Pepsi Challenge’, Coca-Cola found a new formula

Oh what a lovely car… or was it? In fact, the DeLorean DMC-12 was an

Hollywood’s film studios felt expansive during the 1970s. Relatively young directors like Spielberg, Lucas and

Apart from a handful of reigning monarchs and despots, in 1961 Nelson Bunker Hunt was

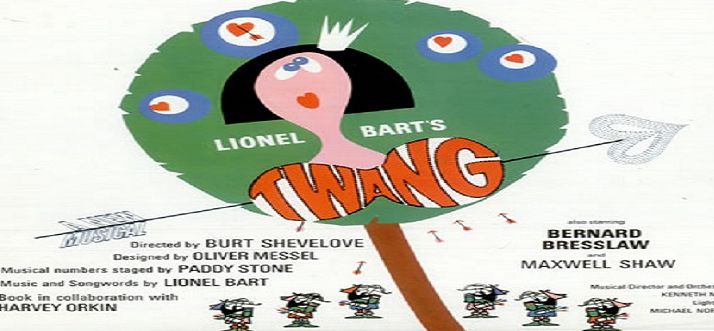

Lionel Bart was the man who wrote some of Britain’s earliest pop chart hits, including

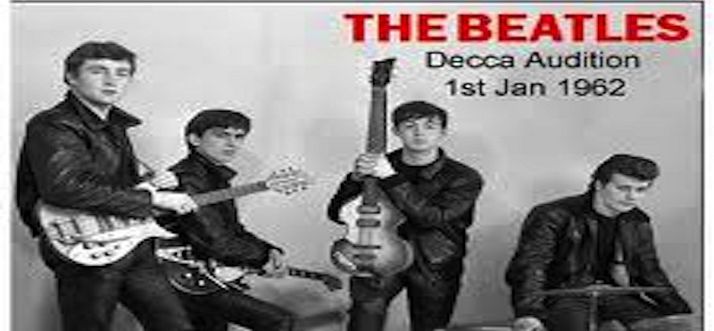

On New Year’s Day 1962, the fledgling Beatles performed 15 songs in one hour at

The new brand was launched with the reassuring reminder that ‘You’re Never Alone with a

Even though nobody knows better how to put a positive spin on failure, not even

More affable scoundrel than kingpin of crime, Charles Ponzi sits astride criminal history as the

Have you ever hated a character so much that you ended up disliking the actor

Stay away from these dangerous neighborhoods! When you are looking to buy a new home

Hurricane Milton heads toward Florida, poised to make a potentially historic landfall. This powerful Category

Are landslides threatening your home? Landslides are a scary type of natural disaster that can