5 Ways America Already Looks Like a Third-World Country

Even though America is a nice and well-developed country that stands out very highly among

Even though America is a nice and well-developed country that stands out very highly among

Have you ever wondered what would happen if America didn’t exist anymore? We all love

Even if data shows that the crime rate has lowered in recent years in the

When you want to relocate and enjoy your retirement but don’t want to break the

To say that money makes the world go around would be a massive understatement, our

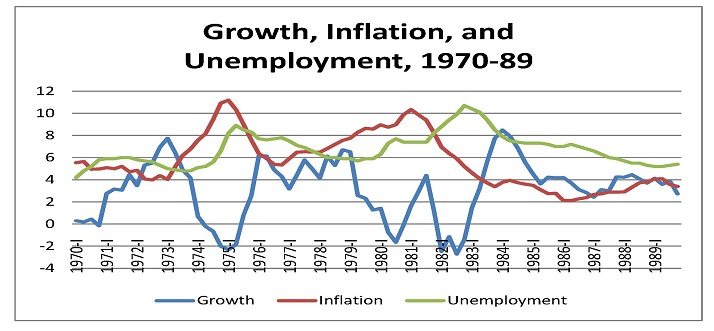

The economy is a fragile thing. There’s a tremendous number of factors which influence it,

Over the years, we have witnessed the rise and fall of many famous businesses. Numerous

Black Thursday received its name because it was on that day that the Stock Market

Even the largest of corporations can go bankrupt, and the Third World has many countries

Lehman Brothers was founded in 1850 by three brothers who emigrated to the USA from

The causes of catastrophic financial events that started unfolding in 2007 were many and varied,

Southern Rhodesia was created by acquisitive British colonial entrepreneur Cecil Rhodes, after whom landlocked territory

Every so often, something happens to change the world, from invention of the wheel through

If there was one thing the Conservative Party cherished – and the British electorate admired

The big winners to emerge from World War II were two superpowers that – like

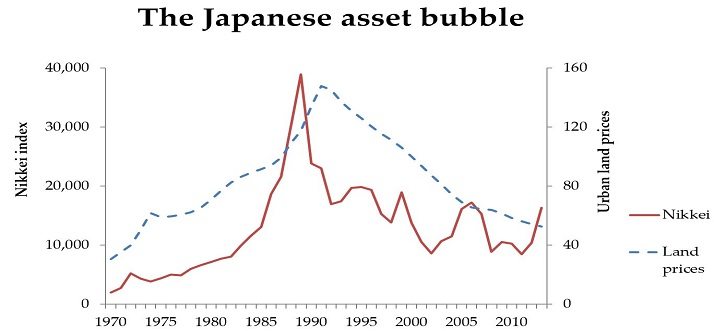

In 1945 Japan was a feudal monarchy that had suffered catastrophic defeat in World War

‘When America sneezes, the rest of the world catches a cold’ so it’s not really

The high life of the Roaring Twenties came to a juddering halt on Black Tuesday

Do you think it’s ok to shoot the leaders of America? We all know what

How clean is the air you breathe? According to a new report, a mere seven

Can the crime rate be reduced in any of these cities? Living in cities with

Chicago is a destination known for its summer fun, sports, entertainment, food scene, diversity, and