Peloton and 5 Other Recalls Due to Safety Reasons

Recently, Peloton recalled more than 2 million exercise bikes due to injury risks. This happened

Recently, Peloton recalled more than 2 million exercise bikes due to injury risks. This happened

Hollywood has long been a place and an industry where talented actors become superstars. However,

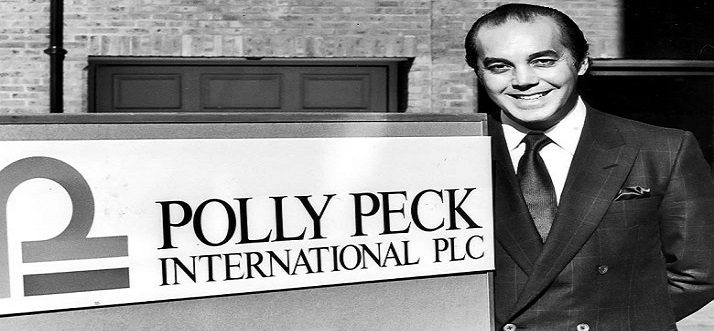

Over the years, we have witnessed the rise and fall of many famous businesses. Numerous

Fascination with disasters seems to be widespread as evidenced by the rapidity with which Hollywood

From the early 1990s Honda pursued high-profile success in the premier international motor-racing series, supplying

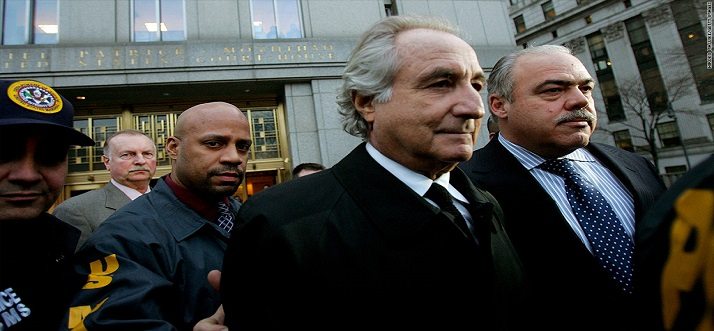

It was inevitable that the fallout from the collapse of international banking and the global

The world now knows to its cost that the great investment banks lost all sense

Five years after its 1999 launch in the USA, Coca-Cola had achieved a marketing miracle

Founded in 1762, the same year as Barings Bank, Equitable Life used to share the

For five years straight, Fortune magazine named it ‘most innovative company of the year’. By

The dotcom frenzy reached its zenith around the millennium. At every stage of its explosive

From the outset in 1974 (Christopher) Dorling and (Peter) Kindersley were successful hook packagers (they

Let’s be clear: this movie is not to be confused with the Oscar-nominated II Postino

Baring Brothers was Britain’s oldest merchant bank, founded in 1762. It collapsed when a single

A legendary lemon, Eldorado was BBC TV’s new soap opera for the 1990s. Conceived as

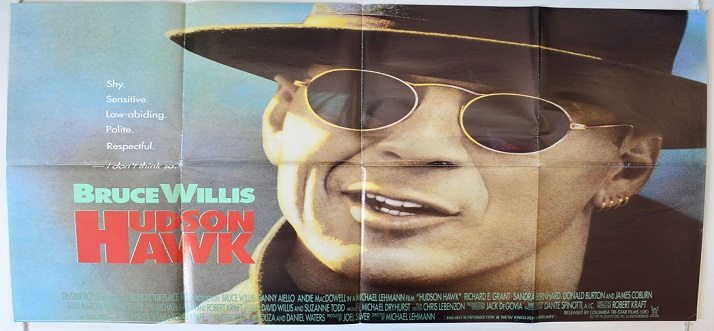

In 1990, Bruce Willis was a newcomer to Hollywood’s high table, riding high on the

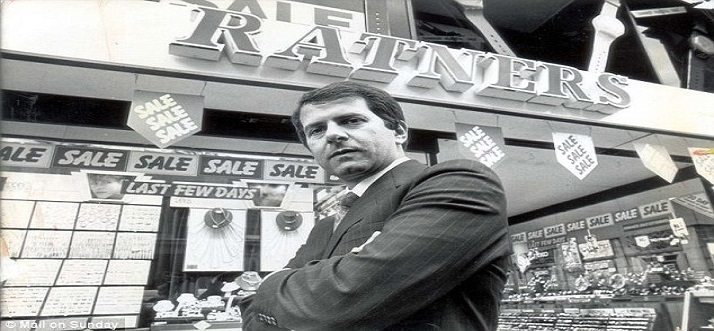

Honesty is not always the best policy. Gerald Ratner inherited a small jewelry business from

In 1940, a new fashion house was formed in London, which traded in a modest

Do you think it’s ok to shoot the leaders of America? We all know what

How clean is the air you breathe? According to a new report, a mere seven

Can the crime rate be reduced in any of these cities? Living in cities with

Chicago is a destination known for its summer fun, sports, entertainment, food scene, diversity, and